Let’s take a look at the top questions is mind before (and after) a student earns an associates in accounting:

- I have an associates degree in accounting now what?

- Is an associates degree in accounting worth it?

I Have an Associate’s Degree in Accounting – Now What?

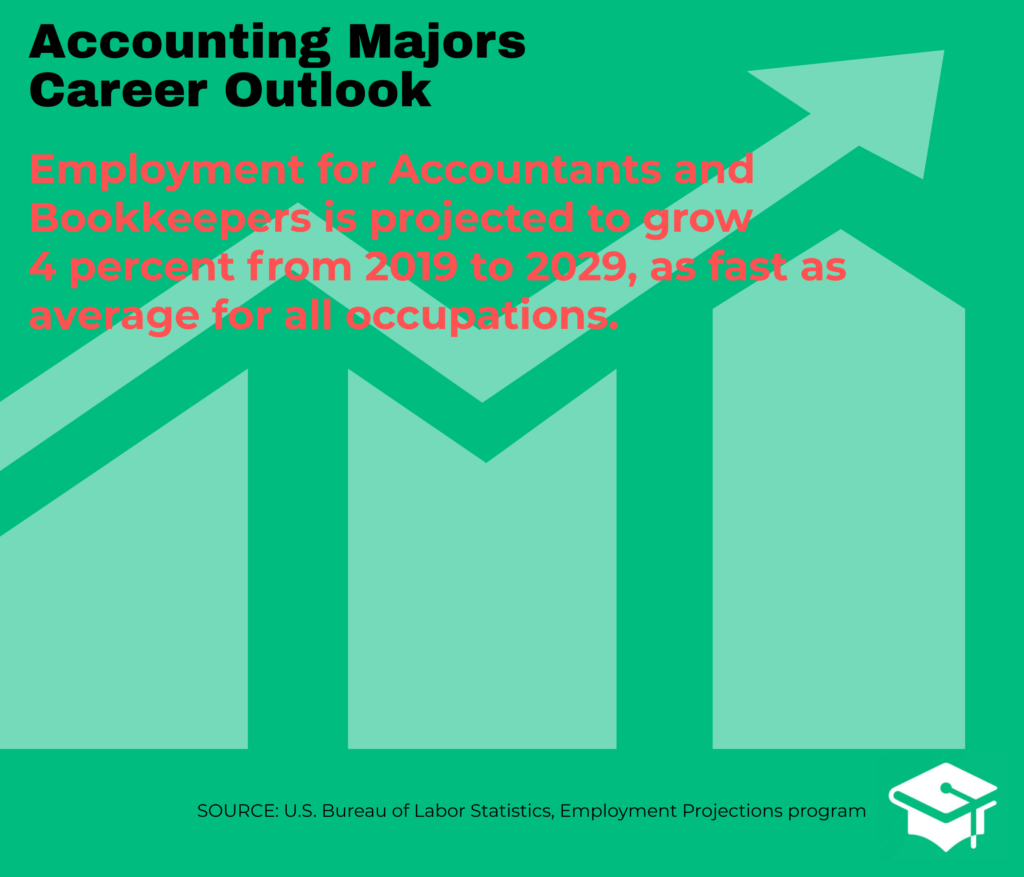

Students who earn their associates degree in accounting typically look for entry level positions in bookkeeping and accounting. After getting a job, a candidate’s salary potential rises. Many candidates also go on to earn their bachelor’s degree to improve their job prospects even more. According to the Bureau of Labor Statistics, accountants with a bachelor’s degree earn approximately $71,550.

Students studying for their associates degree in accounting typically qualify for financial aid. They may also be able to get scholarships from the college or university that they choose. It’s also worthwhile to look around online for scholarship opportunities to reduce student debt and help pay for school.

While students may find work in accounting after getting there AA or AS in accounting, it’s a good idea to get a bachelor’s degree to find higher paying jobs in the field. Typical jobs how by those with an associate’s degree in accounting include bookkeeping clerk, accounting assistant, and auditing clerk.

Accreditation for Accounting Programs

There are two main regional accounting bodies for accounting and bookkeeping programs. Here’s a look at the difference between ACBSP vs AACSB.

ACBSP vs AACSB

Finding schools accredited by the Association to Advance Collegiate Schools of Business (AACSB) or Accreditation Council for Business Schools and Programs (ACBSP) can help students verify the quality of their chosen university.

The qualities of each are listed below.

AACSB

Established in 1916, the AACSB accredits schools that seek ties with local communities and have business programs that focus on business ideals. The schools must also demonstrate that they have high quality faculty members and provide quality job opportunities for graduates. AACSB schools also have business and accounting programs with baccalaureate and graduate level courses available.

Schools seeking this accreditation must provide a self-evaluation and undergo rigorous peer reviews. This certification is awarded to just 5% of business schools. Graduates of these schools can seek employment anywhere in the world. Typically, larger business programs qualify for this accreditation, and some companies reserve tuition reimbursements for schools with AACSB accreditation. Of course, ivy league business schools typically have this gold standard accreditation.

AACSB accredited online schools and on-campus programs provide excellent credentials for graduates.

ACBSP

Established in 1989, ACBSP accreditation also require schools to engage with local communities. There are more than 3,000 programs accredited by this organization. These schools also must pass a peer vetting process. Accredited schools receive a review every two years following their accreditation.

Like the AACSB, this accreditation emphasizes quality determined by a third party. Both on campus and accredited online accounting degree programs can qualify for both the AACSB and ACBSP.

ACBSP is it considered a regional accreditation (it’s international in scope). However, U.S. schools must have regional accreditation in order to be considered for ACBSP accreditation. schools who pursue this track focus on business training.

Courses often include communication, writing, financial theories, information technology, decision-making skills, organizational management, and exposure to how global organizations work. AACSB schools emphasize basing business decisions on evidence. There’s also a heavy emphasis on business management insights. Therefore, AACSB accreditation often goes to research universities.

Schools that don’t focus on research may seek the ACBSP accreditation instead. ACBSP schools often focus on both teaching and research. The ACBSP recognizes notable schools that do not meet the AACSB guidelines.

In general, ACBSP accreditation applies to a range of programs, Including MBA, master’s, doctoral and two-year colleges. Meanwhile, AACSB provides international accreditation and is more prestigious than U.S. regional accreditation. Students should always choose an accredited online accounting degree to ensure that they can find work after completing their degree.

ACBSP Accredited Schools

ACBSP universities are highly respected but may be overshadowed by AACSB schools. However, the reality is that this is still a very valuable designation. It’s important to choose the right school to maximize the marketability of the degree. Choosing the right courses and concentration are equally important. For instance, program qualities vary between schools and an ACBSP designation can help students be confident that they are choosing a school that employers respect.

ACBSP accredited schools may not have the same research backgrounds as other universities. So, students must decide whether they are the right match for their career path. However, ACBSP schools are approved by the Council for Higher Education Accreditation (CHEA). There are many more schools with an ACBSP accreditation than AACSB because AACSB has much stricter standards and there are fewer schools with this credential.

Here is one big difference. ACBSP accreditation focuses on ensuring good schools receive their accreditation, while the accounting school accreditation process for AACSB focuses on exclusivity.

AACSB accredited online schools hold the same prestige there on campus counterpart. The accounting school accreditation that is best for each student varies on what their career plans are. However, AACSB accreditation is undeniably the blue ribbon of business schools. With only a handful of schools enjoying this distinction, it adds even more to the mystique of the AACSB accreditation.

So, what do students get from a AACSB schools? These colleges and universities provide a world-class learning experience. Faculty members at AACSB schools come from those at the highest peaks in their specializations. It’s not uncommon for world experts and famous thought leaders to teach at business goals with this credential.

You can also expect is there a rigorous curriculum at these top schools. They want to challenge students in every way, and students often have to complete independent research prior to graduation.

After students graduate from an AACSB-accredited school, they have peerless opportunities in their careers. Those who go on to achieve a bachelors or Masters from an AACSB school, often going to become leaders in corporations and organizations around the world.

Types of Accounting and Bookkeeping Associate’s Degrees

When students study for their associate in accounting degree, the first thing they have to determine is whether they want to attend classes in person or online. Many people feel that online programs are not as rigorous or valuable as traditional classroom programs. This couldn’t be further from the truth. Of course, there are good and bad universities both online and offline. Students should stick to associate degree in accounting programs that are accredited for added assurance.

Consider both institutional and programmatic accreditation. Reputable universities have some sort of institutional accreditation. This ensures that they meet the level of quality expected by other regional schools and area employers, which is extremely important when it comes to getting hired or transferring credits.

Programmatic accreditation is awarded to departments and degree programs within each school. this accreditation involves a more thorough audit of course material and learning objectives than regional or national accreditation for an entire institution.

The best online associates degree in accounting programs are ACBSP or AACSB schools. As discussed above, the top schools have ACBSP accreditation and other excellent colleges and universities may hold an AACSB or another accreditation.

The best online associates accounting degree will differ for each student. However, online accounting degrees are much more flexible than classroom-based learning. Many students appreciate being able to study from home on their own time schedule. Learners may have full time jobs, families and other responsibilities that compete with and prevent them from attending classes in person. Not all online schools offer the same flexibility. Therefore, it’s important to understand the expectations of a program before applying and signing up for classes.

When choosing an associates degree in accounting online, there are many factors to consider. For example, students should check whether a program is asynchronous or synchronous. If courses are offered on a synchronous basis, students have to sign in for live stream lectures, and they have to participate in live discussions. Some students like the sense of community they can develop when attending lectures with other students online. Others feel that it takes away their freedom to complete their classwork around their busy schedule.

On the other hand, asynchronous programs have different requirements. With asynchronous courses, there are still delivery deadlines, but students can complete the work and do the lectures at a time that’s convenient for them. As long as they meet the deadlines, they have a lot of leeway when it comes to their education. Students taking asynchronous classes don’t have the same interaction that appeals to some learners.

So, understanding how you work best is important to thriving in an online environment. With asynchronous platforms, students don’t have to worry about scheduling conflicts. However, they may miss not speaking with or chatting with other students in class. Many programs combine asynchronous and synchronous components. Programs that adopt just one format are more likely to be asynchronous due to the popularity of that format.

There are also hybrid programs that offer some courses online and some in person classes. This is offered more at the master’s and doctoral levels than an associate’s degree. Students also have to determine whether they want a completely online program or one that also has some in-class components. Some advanced degrees include research and a thesis or dissertation. However, many associate in accounting degree programs are fairly straightforward and may not require in-person classes or consultations.

With a little research, learners can find associate degree in accounting programs that allow them to interact with faculty, peers and industry leaders either online or in person. Even if a student chooses a completely online route, there may be job fairs and other events they can attend to meet other students in their program.

Students who work or live in remote areas have a hard time making it to in-person classes on a regular basis. For them, online learning may be the only option to pursue their degree.

With an online associates degree in accounting, it’s rare to have a lot of specialization options. However, students can choose an online associates accounting degree that has electives that reflect their career interests. With an associates degree in accounting online, students should look for programs that allow them to customize their degree.

Whether taking classes online or on campus, students can choose from an array of electives that can help them enrich their studies. Some associate’s degrees programs may offer concentrations in a particular area such as bookkeeping or corporate accounting. Students who focus their electives in a particular area maybe more prepared to complete their baccalaureate degree in their chosen concentration.

Certifications offer another way for students to enrich their knowledge in a particular area. Whether students like bookkeeping or financial statements, they can take online or traditional classes for the topics they would like to pursue. Specializations in bookkeeping or taxation are available but fairly rare.

It’s sometimes difficult to rearrange degree program once you are accepted. That’s why it’s better for students to shop around and find a program that fits their needs. Fortunately, many programs accommodate students needs as much as possible. However, they tend to favor particular career paths. In some cases, the school may have a relationship with employers in a particular area, which is great if you want assistance finding employment after graduation. Other programs provide a smattering of courses that prepare students for their bachelor’s degree.

Certifications/Licenses

Is a bookkeeping certificate worth it? There are many certificate programs available for accounting and bookkeeping. For students who already work in the field, it may make sense to get a certification to help them advance in their career or to obtain competency in particular areas.

Is an accounting certificate worth it? Accounting certificate programs prepare participants for entry level jobs such as an accounting clerk position. Many students use certificate programs to help them prepare for a two-year or four-year degree.

Those wondering how to get an accounting certificate online should do some research online, talking to admissions advisors to determine if a school can meet their education goals.

The University of California Berkeley has an accounting certificate program mainly attended by students with full-time or part-time jobs. Some of these students already have a bachelor’s degree in a field other than accounting. By obtaining a certificate an accounting, they can ease into a career change.

Is an Accounting Certificate Worth It?

For students who want to get started on their education as soon as possible, an accounting certificate can give them a broad overview of the field. By choosing a school with certificate and associates degree programs, learners may be able to transfer their certificate program credits to an AS or AA in accounting program. It’s a good idea to check whether certificate course credits will smoothly transfer into a longer program at the school a student chooses.

Universities typically give students a timeframe within which to complete the required courses. For example, if a certificate program has seven courses, students may get up to two years to complete them. For more intensive certifications requiring more classes, students may have up to five years to complete them part-time. Limits vary by program and university.

Here are some examples of classes students may encounter in accounting or bookkeeping certification programs:

- Introduction to Finance Accounting

- Accounting Ethics

- Introduction to Managerial Accounting

- Intermediate Accounting I & II

- Advanced Accounting

Certification programs concentrate on giving students a complete understanding of the subject. This can help students immerse themselves into bookkeeping and accounting concepts. Many professionals who work as bookkeepers and small companies have a certificate in accounting. However, the scope of work for those with a certificate is limited.

Is a bookkeeping certificate worth it? For students who need to work as quickly as possible, it makes sense to get a bookkeeping certificate to get an entry level job. They can then go on to obtain their associate’s degree or bachelor’s degree when they have the time and funds to do so. Certificate programs are also typically cheaper than two year and higher levels of education.

For students who want to know how to get an accounting certificate online, it basically comes down to lots of research, talking to admissions counselors and determining what they want from their education.

Is a certificate in accounting worth it? Students definitely get a good return on investment with a certificate program in accounting. If nothing else, it’s a good step to determine whether they would enjoy a career in accounting or bookkeeping.

For those who want to become a Certified Public Accountant, targeted certificate programs can help them prepare for the competitive exams. Many employers are willing to pay more for accountants with a CPA designation.

Unfortunately, it’s difficult to get a CPA with just an associate’s degree in accounting. In many states, candidates for the CPA must have a minimum of 150 college credits before they can even attempt to get the certification. For some programs, students can substitute one year of working experience for part of the minimum credit requirement.

There are a few certificate programs that stand out in the field. Students can consider getting the Certified Management Accountant designation from the Institute of Internal Auditors. The organization also offers certifications for certified government auditing professionals and certified internal auditor specializations.

Careers in Accounting and Bookkeeping

Some students may want to know, “What can I do with an associates degree in accounting?” There are many associates accounting degree jobs available. However, accounting jobs with an associate degree tend to be entry-level positions as clerks and similar titles.

Online entry-level accounting jobs are available in almost every industry. So, graduates seeking associates degree in accounting careers get jobs in a wide spectrum of environments, including schools, corporations, nonprofits, and government agencies.

What can I do with an associates in accounting? Most graduates with an AA or AS in accounting work in corporate offices or for smaller companies willing to give a newcomer a chance (typically with less pay).

Accounting associates degree jobs include the following:

- Accounting Technician

- Administrative Assistant

- Accounts Payable and Accounts Receivable Administrator

- Auditing Clerk

- Accounting Assistant

- Payroll Clerk

- Tax Preparer

- Bookkeeper

Other careers with an associates degree in accounting may include office assistant or receptionist at an accounting firm. Associates degree in accounting careers are also available on a work from home basis. There are also many online entry level accounting jobs available through various hiring platforms, include indeed.com and glassdoor.com.

Associates accounting degree jobs may include travel to meet with clients. However, that’s rare. Although licensed accountants work independently, accounting jobs with an associate degree often involve assisting CPAs in an office environment.

What can I do with an associates degree in accounting if I want to work part-time? Some accounting associates degree jobs are seasonal. For example, H&R Block and other tax preparation companies often hire extra help during tax season. (Although you don’t always need a degree to work as a tax preparer.) Students who want to go to school part-time to pursue a bachelor’s or finish their associate’s degree can gain experience without commitment to year-round employment.

What can I do with an associates in accounting? Careers with an associates degree in accounting include these job titles: financial analyst, accounting clerk and bookkeeper. Graduates with more experience and additional degrees can also secure better paying work as payroll managers, accounting supervisors, or senior budget analysts.

Salary

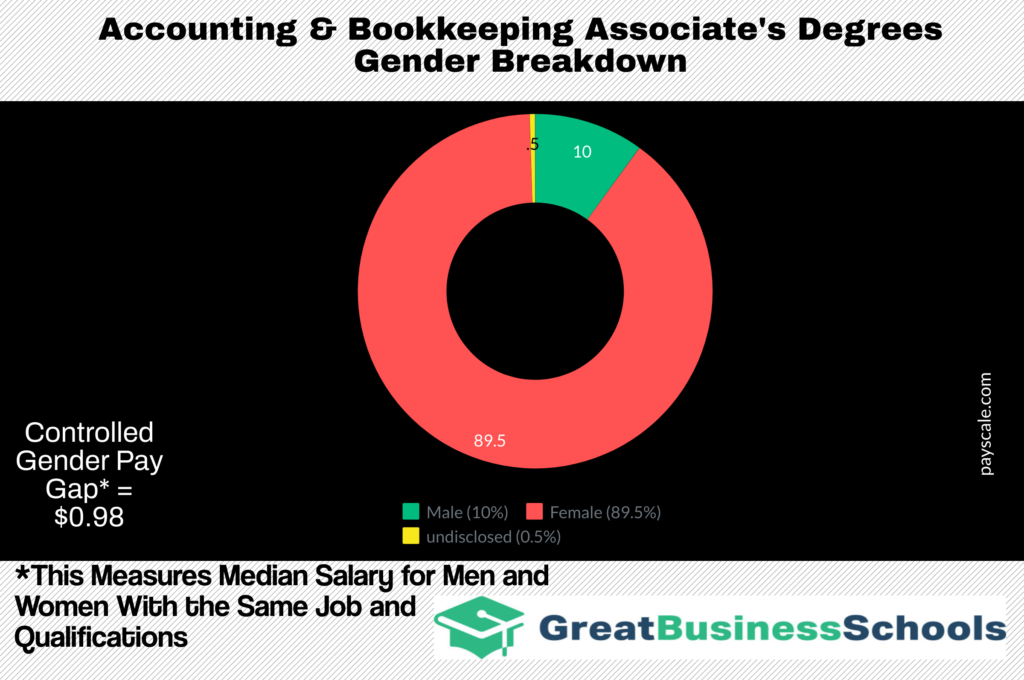

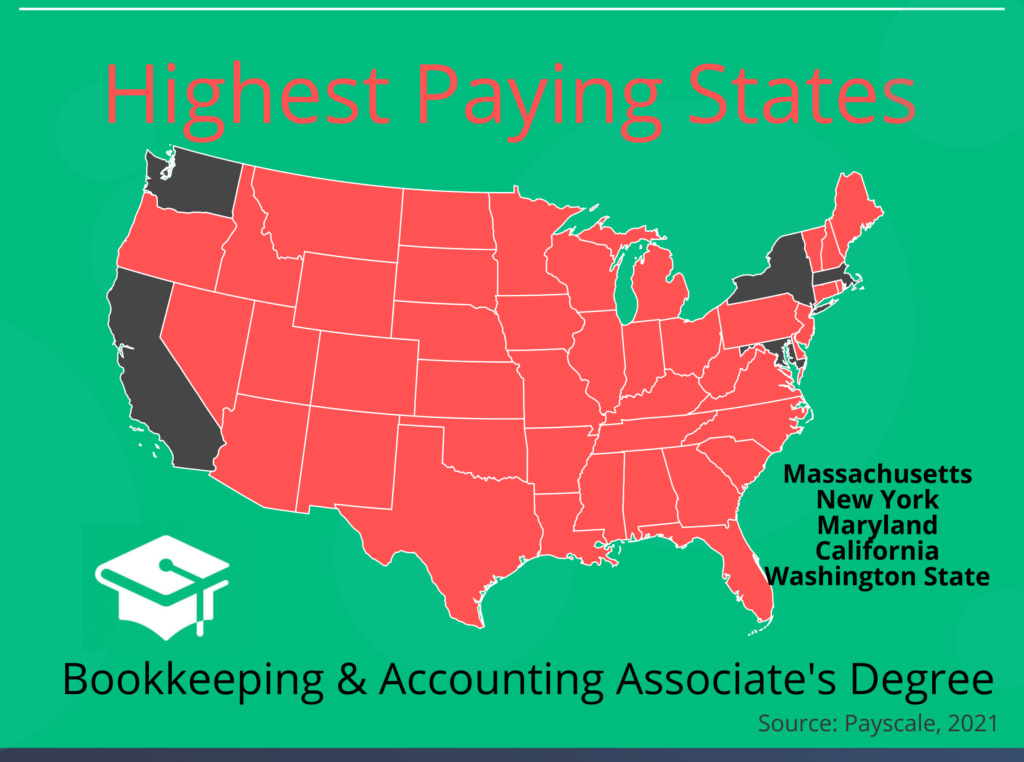

How much can you make with an associates degree in accounting? In general, graduates with a baccalaureate degree will generally make more than someone with an associates in accounting salary. However, potential associates degree in accounting salary ranges are not too shabby either.

How much money can you make with an associates degree in accounting? Let’s take a look at how an associates degree in accounting salary stacks up in the industry.

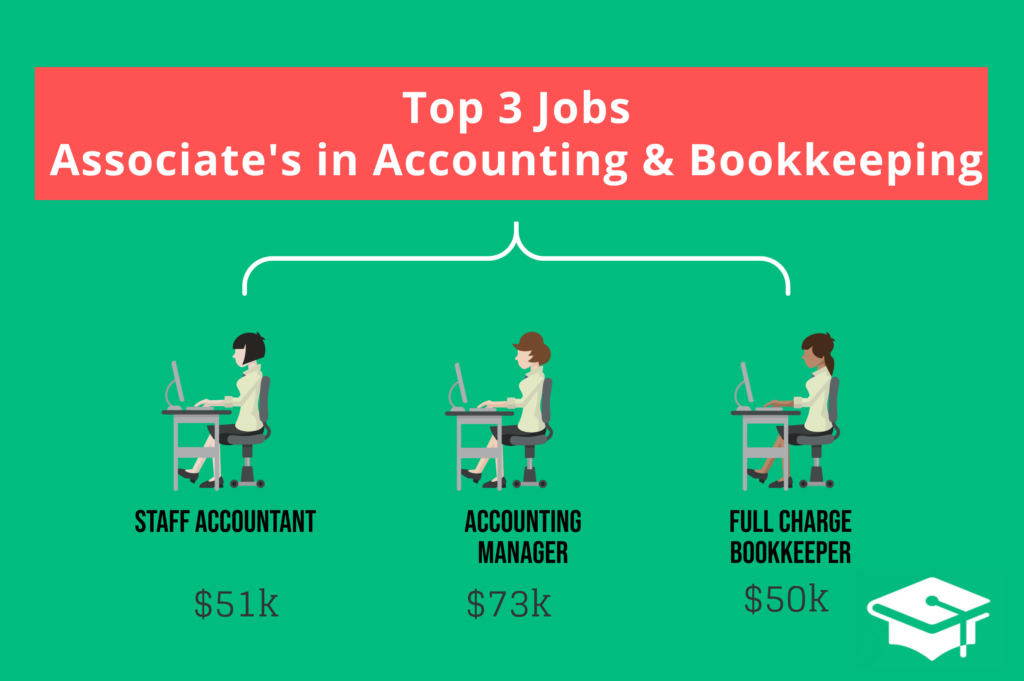

How Much Can You Make with an Associate’s Degree in Accounting?

According to salary.com, an associates in accounting salary range of $52,702 – $55,610 compares well to a bachelor degree salary range of $53,522 – $56,347. With a Master’s Degree or MBA, accountants make between $54,268 – $57,188 on average.

How much money can you make with an associates degree in accounting? It depends who you ask. According to payscale.com, AA and AS graduates make an average of $51,139, with the lowest 10% making $32,000 and the highest 10% bringing home $85,000.

As a comparison, here are the average of common accounting roles.

- Staff Accountant $43k

- Accounting Specialist $44k

- Accountant $47k

- Office Manager $47k

- Payroll Administrator $52k

- Business Manager $55k

- Accounting Manager $59k

Professional Organizations

Students can join professional organizations to meet other individuals in their field. Some of the top accounting professional organizations for students include:

- American Association of Finance and Accounting

- The Institute of Internal Auditors

- Institute of Management Accountants

- Professional Association of Small Business Accountants

- Young CPA Network

There are an unprecedented number of organizations that students can join. However, students should choose the associations that align with their career goals. Professional organizations that offer general skill development, networking opportunities and business development opportunities can help students secure the contacts needed to land a good position.

Carrie Morris

Author

Warren Dahl

Editor-in-Chief