Africa evokes images of wild extremes. Poverty, culture, natural beauty, and resource richness side by side. While many aspects of the developing world are still very much developing, years of progress have made many urban centers in Africa unrecognizable from what they were two decades ago.

The growth in global interconnectedness has potentially aided locations that weren’t connected to begin with the most. This is undeniably the case for African metros who have embraced tech or finance as their sectors de jour. Exceedingly low cost of living, surprisingly well educated workforces, and incentives to relocate to many African nations make a number of opportune locations in the continent some of the best locations to start a new business (or expand to).

In this guide we looked at the state of national economies in Africa. Which in many cases are largely centered around one large metro area. While the below nations aren’t “ranked” per se, all ten stand out in terms of stability and economic opportunity in tangible ways.

While we advise looking through individual nation entries for specifics on their business-friendly policies. We’ve also included a quick a quick reference of larger economic and social indicators below:

Nigeria

GDP: $397.3 Billion , 1.9% ↑

Projected economic growth: 3.3% in 2021.

Nigeria is a large nation of close to 200 million people located on the Gulf of Guinea south of the Saharan Desert. Nigeria is the largest economy in Africa. And over the last several decades has been the largest recipient of direct foreign investment. Over this period of time Nigeria has streamlined the process of moving a business to Nigeria, and incentives foreign businesses in a range of ways.

Incentives:

- Reduced time for registration at the corporate affairs commission and introducing an online platform to pay stamp duty.

- The government permits up to 100% foreign ownership in various sectors

- Free transferability of capital and returns

- Double Taxation Treaties for countries such as Belgium, Canada, China, France, the Netherlands, Pakistan, Philippines, Romania, South Africa, and the United Kingdom . Investors from countries with a Double Taxation Treaty with Nigeria pay a discounted percentage of 7.5% on dividends.

- Tax Incentives

- Agricultural production is exempt from income tax for a period of 5 years, extendable for an additional 3 years.

- Investors in the health sector enjoy import duty waivers on medical equipment and pharmaceutical products.

- investors in the mining sector enjoy waivers on mining equipment.

- Incentive for FINTECH Companies with more time to consolidate and source for investments.

Literacy rate: 62.02%

Tertiary school enrollment: 10,2% (2011)

Political stability index:-2.19 (2018)

Best cities for business: Lagos and Kano

Note: Nigeria was among the forty-six economies in the world that improved across three or more categories the World Bank considers in its analysis.

Ivory Coast

GDP: $43.01Billion , 7.4% ↑

Projected economic growth: 20% in 2021.

The Ivory Coast is one of the most quickly expanding economies in the world with 20% growth expected through 2021. While expat safety is still more of a concern in the Ivory Coast than some other locations in our guide, many foreign entities have started up shop in this up and coming nation. An official language of French lowers the language barrier for much of the world.

Incentives:

- Foreign tax credit: Income derived from business conducted outside the country is not taxable, no tax credit is allowed.

- The introduction of a new Investment Code.

- The establishment of a one-stop shop for business creation.

- The establishment of online complaints debits at the Commercial Court.

- A programme of major transport infrastructure projects, including the privatisation of the Abidjan-Ouagadougou railway line and the extension of the port of Abidjan

A national development plan has been developed for the period 2016-2020 which aims to make private investment a driver of the country's economic growth. In order to facilitate business, a program of dematerialisation of services and administrative acts has been put in place. Tax relief measures were also introduced.

Literacy rate: 47.17%

Tertiary school enrollment: 9.34% (2017)

Political stability index: -0.93 (2018)

Best cities for business: Abidjan

Note: The country is one of the top 10 improvers in the world in the Ease of Doing Business rankings.

Morocco

GDP: $117.9 Billion , 3% ↑

Projected economic growth: 4% in 2021.

Morocco boasts one of the most well educated workforces in Africa, in particular a strong workforce around clean energy, aeronautics, and automotive tech is present. Road, energy, and port infrastructures are some of the best in Africa and have largely been updated in the last two decades. Additionally, Morocco is often referred to as a sort of gateway nation to Africa. Many European nations gain access to African markets as well as raw goods through Morocco.

Incentives:

- The 2020 budget envisages a cut in the tax rate for industrial firms to 28% from 31%, with a target of 20% in five years.

- FREE TRADE ZONES: Export Processing Zone of Tangier, Tanger Med Ksar el Majaz free zones Mellousa 1 and 2, Dakhla and Laayoune free zones, Kebdana and Nador free storage zones for hydrocarbons, Kenitra export processing zone, Casablanca Aeropole Nouaceur and Midparc free zones.

- Companies pay lower tax rates in exchange for an obligation to export at least 85% of their production

- Industry-specific incentives for firms in automobiles, aerospace and renewable energy

- VAT exemption for imports of equipment, materials and tools for firms undertaking investment projects worth at least $20m. Incentive lasts for 36 months from the start of the business

- CASABLANCA FINANCE CITY (CFC) - Firms receive a variety of incentives, including exemptions from corporate taxes, for the first five years after receiving CFC status. This is to encourage businesses to locate their regional headquarters in Morocco

- FUNDING SCHEMES: Various subsidy schemes for local and foreign businesses including the Investment and Industrial Development Fund and the Hassan II Fund

Literacy rate: 73%

Tertiary school enrollment: 35.9% (2018)

Political stability index: -0.33 (2018)

Best cities for business: Casablanca

Note: Tourism and manufacturing are expected to be the key growth drivers of the economy. The manufacturing sector is also expected to benefit from substantial foreign investment into the auto and aeronautics industries. Morocco positions as the second transmitter of African FDI in Africa after South Africa.

South Africa

GDP: $368.3 Billion , 0,8% ↑

Projected economic growth: 1,8% in 2021.

Though with a slightly troubled legacy, South Africa has emerged as one of the strongest economies in Africa on several fronts in recent years. A relatively young nation, the country is governed by a 1996 constitution hailed as one of the most progressive in the world. English is spoken by around 10% of the population (one of the higher rates of any African nation). And South Africa has globally competitive firms in high tech fields including finance, health care, and manufacturing.

Incentives:

- The Export Marketing and Investment Assistance (EMIA) Scheme includes support for local businesses that wish to market their businesses internationally to potential importers and investors. The scheme offers financial assistance to South Africans travelling or exhibiting abroad as well as to inbound potential buyers of South African goods.

- A great list of schemes and programs that help both companies and investors in each stage of the process depending on the industry and other variables that you can find here: Incentive schemes in South Africa

Literacy rate:87.05%

Tertiary school enrollment: 22.37% (2017)

Political stability index: -0.28 (2018)

Best cities for business: Johannesburg, Cape Town.

Note: Africa’s second largest economy is one of the easiest places to do business on the continent with advanced legal and financial structures.

Kenya

GDP: $87 Billion , 5.5% ↑

Projected economic growth: 5.9% in 2021.

Despite a reputation to the contrary, Kenya has emerged as one of the safer locations to relocate in Africa. A range of incentives for foreign investors as well as the third highest university school enrollment rate of nations surveyed round out this business destination. Within Nairobi a vibrant nightlife, culinary offerings, and populace known for friendliness make the capital city a destination.

Incentives:

- An investor who incurs capital expenditure on building and/or machinery used for manufacture is entitled to an investment deduction equal to 100% of the cost.

- For capital expenditures on building and/or machinery exceeding sh.200 million if the investment is outside Nairobi the investor can claim 150% allowance.

- Industrial Building Deduction is an allowance granted to an investor who incurs capital expenditure on a building used as an industrial building at the rate of 10% of the cost (net of investment deduction, if any)

- An investor who incurs capital expenditure on the purchase of the right to use a computer software used by him in business is entitled to a straight line deduction at the rate of 20% of such cost.

- Capital expenditure on buildings and machinery for use in a Special Economic Zone shall be entitled to an Investment deduction equal to one hundred percent of the capital expenditure.

- For newly listed companies, there are preferential corporate tax rates dependent on the percentage of listed shares up to 27%

- (https://www.kra.go.ke/en/ngos/incentives-investors-certificate/investing-in-kenya/incentives-investors)

Literacy rate: 81.5%

Tertiary school enrollment: 11.46% (2017)

Political stability index: -1.16 (2018)

Best cities for business: Nairobi

Note: One of the world’s best performers in the areas of Getting Credit and Starting a Business, according to the World Bank.

Ethiopia

GDP: $84.36 Billion , 6.8% ↑

Projected economic growth: 4.33% in 2021.

Ethiopia is the second most populous country in Africa and the world’s most populous landlocked nation. Comprised of over 80 ethnic groups, the diversity of the nation is astounding. Driving forces in business in recent years have included increased manufacturing for exports. With a government that has pinpointed the lack of a strong private sector as a specific challenge it wants to address, the business climate is good and scheduled industrial-site developments are occurring.

Incentives:

- Around 28 licensing and registration services in a relatively short timeframe

- Approval of incentives for agro-processing and other investment ventures

- Complaint handling by executing officials

- The Ethiopian Investment Board overseeing our (EIC’s) activities,

entertainment issues beyond our juridical capacity - One Stop Shop services in all industrial parks

- Customs duty exemptions and income tax exemptions for several sectors. http://www.unido.or.jp/files/Ethiopia-Investment-Policies-and-Incentives-and-Opportunities.pdf

Literacy rate: 51%

Tertiary school enrollment: 8.11% (2014)

Political stability index: -1.34(2018)

Best cities for business: Addis Ababa

Note: The Ethiopian Investment Commission (EIC) launched an online investment guide, iGuide, in December 2018. The platform, created with support from the United Nations Economic Commission for Africa (ECA) and the United Nations Conference on Trade and Development (UNCTAD), will help investors discover opportunities in the country, business costs, key procedures and laws.

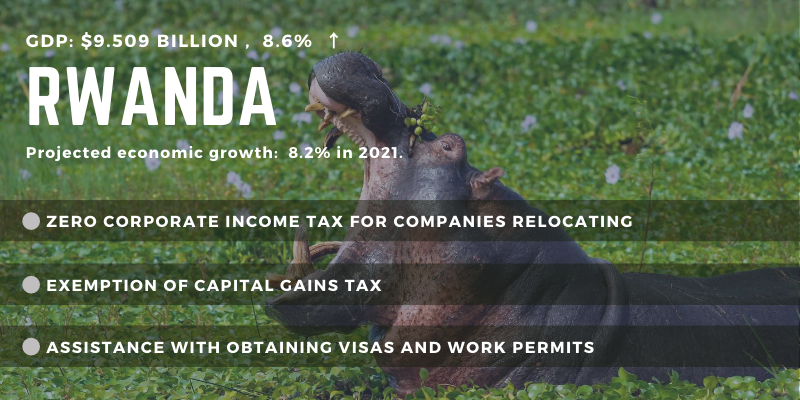

Rwanda

GDP: $9.509 Billion , 8.6% ↑

Projected economic growth: 8.2% in 2021.

Rwanda is a relatively small nation with a complex and troubled political past. In recent years, however they have emerged as a nation rapidly lowering poverty rates and with a GDP that has grown more than 10% a year for several recent years. One of the largest incentives of any nation on this list is present for Rwanda: no corporate income tax for companies who relocate their headquarters to Rwanda.

Incentives:

- Zero corporate income tax for companies planning to relocate headquarters to Rwanda

- 15% preferential corporate income tax for strategic sectors i.e. energy, transport, affordable housing, ICT and financial services.

- Accelerated depreciation of 50%for key priority sectors i.e. tourism, construction, manufacturing and agro-processing

- Exemption of capital gains tax

- Seven-Year corporate income tax Holiday for large projects in strategic sectors i.e Energy, Exports, Tourism, Health, Manufacturing and ICT

- Repatriation of capital and assets

- Non-fiscal incentives

- Quick business and investment online registration

- Assistance with tax-related services and exemptions

- Assistance to access utilities (water & electricity)

- Assistance with obtaining visas and work permits

- One stop center that provides notary services

- Provision of Aftercare services to fast track project implementation

Literacy rate: 73.22%

Tertiary school enrollment: 6.73% (2018)

Political stability index: 0,12 (2018)

Best cities for business: Kigali

Note: Rwanda has replaced its bureaucratic structures with an electronic system. Last year, it replaced its stifling special billing machine system for value-added tax invoices with free software that allows taxpayers to issue value-added tax invoices from any printer. Also, the country is only second to New Zealand in the ease of property registration in the world.

Ghana

GDP: $65.56 Billion, 6.3% ↑

Projected economic growth: 5.4% in 2021.

Over recent decades Ghana has approached democratization with a vibrant multi-party political system. It’s typically rated in the top 3 nations in Africa for freedom of speech and the press. Growth has remained strong for much of the last decade and whereas the nation traditionally relied on oil production for a large share of their GDP, this has diversified in recent years.

Incentives:

- Custom duty exemption for agricultural and industrial plants, machinery and equipment imported for investment purposes

- Listed companies enjoy corporate tax of 25% and newly listed companies enjoy 25% corporate tax for the first three years.

- Location Incentives (tax rebate) for manufacturing industries located in the regional capitals

- Free transferability of capital, profits and dividends

- Insurance against non-commercial risks – Ghana is a signatory to the World Bank's Multilateral Investment Guarantee Agency (MIGA) Convention

- Double Taxation Agreements (DTAs) – to rationalize tax obligations of investors in order to prevent double taxation. DTAs have been signed and ratified with France and the United Kingdom. DTAs have been signed with Germany and concluded with Belgium, Italy and Yugoslavia

Literacy rate: 79.04%

Tertiary school enrollment: 15.69% (2018)

Political stability index: 0,03 (2018)

Best cities for business:Acra, Kumasi.

Note: Ghana has been under the watchful eye of the IMF since the $918 million credit deal agreed in 2015.The government says it’s working hard to build a resilient and robust economy to avoid a return to the IIMF for a financial bailout.

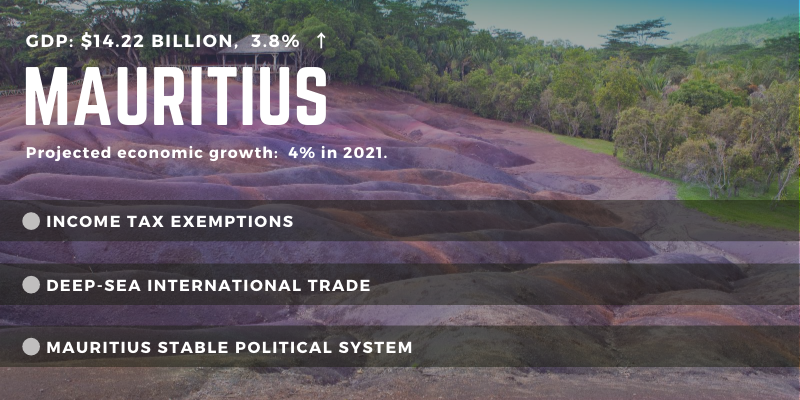

Mauritius

GDP: $14.22 Billion, 3.8% ↑

Projected economic growth: 4% in 2021.

Mauritius is a beautiful island nation located in the Indian Ocean. Home to only slightly more than a million people, the nation is also one of the most developed in Africa and aims to achieve high income status by 2025. Mauritius is cited as one of the easiest nations to do business in in the world with a well educated and multilingual workforce, transparent governance, and incentives for a variety of sectors.

Incentives:

- Owners of foreign vessels registered in Mauritius are exempt from income tax on income derived from the operation of such vessels.

- Owners of local vessels registered in Mauritius are also exempt to the extent that the income is derived from deep-sea international trade only.

- Income tax exemptions are available for companies that are involved in innovation-driven activities for IP assets developed in Mauritius.

- Income tax exemption is available for companies for the manufacture of pharmaceutical products, medical devices, and high-tech products.

- Income derived from the exploration and use of deep ocean water for air conditioning installations, facilities, and service.

- Further, a company incurring expenditure on deep ocean water air conditioning may deduct from its gross income twice the amount of the expenditure incurred in that tax year. That deduction will be allowed for five consecutive tax years, starting from the year in which the expenditure is incurred.

- Another tax exemption has been granted for interest derived by individuals and companies from debentures or bonds issued by a company to finance renewable energy projects (the issue must be approved by the Director General of the MRA).

- If a company incurs expenditure in a tax year for the acquisition and setting up of a water desalination plant, it may deduct from its gross income twice the amount of the expenditure incurred in that tax year.

Literacy rate: 91%

Tertiary school enrollment: 40.6% (2017)

Political stability index: 0,87 (2018)

Best cities for business: Port Louis, Curepipe.

Note: Mauritius’ stable political system, liberal financial sector and low taxes which encourage business formation have made it an ideal environment for investors who prefer a business-friendly and less risky investment environment.

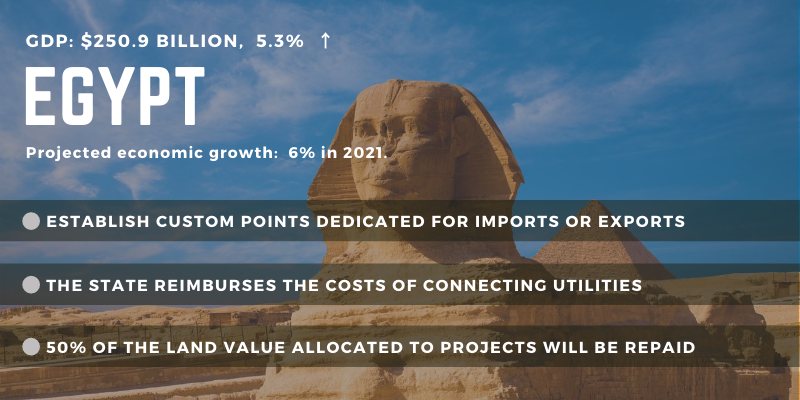

Egypt

GDP: $250.9 Billion, 5.3% ↑

Projected economic growth: 6% in 2021.

Egypt has long been a trade player throughout the Mediterranean and Middle East. As a crossroads of sorts a huge variety of goods pass through Egypt and its strategic importance in many businesses cannot be understated. With one of the most well educated workforces in Africa and quick access to two other continents, Egypt is well positioned for businesses looking to gain access to African markets.

Incentives:

- It is allowed to establish custom points dedicated for imports or exports of an investment project, after approval by the Minister of Finance.

- The state reimburses the costs of connecting utilities to buildings related to the investment project.

- The state reimburses part of the vocational training expenses.

- 50% of the land value allocated to industrial projects will be repaid, conditional to production commencing within two years from the date of receiving the land.

- Projects will enjoy a rebate of 30% to 50% (depending on the project) of the investment cost in the form of tax deductions over a period of time.

Literacy rate: 71.17%

Tertiary school enrollment: 35.16% (2017)

Political stability index: -1.16(2018)

Best cities for business: Cairo, Aswan

Note: Notable among the reforms are reducing the time to start a business to 11 days now, from 16 days earlier; and strengthening corporate transparency to protect the rights of minority investors.

*Political stability index (-2.5 weak; 2.5 strong)For comparison, the world average in 2018 based on 195 countries is -0.05 points.

Projected economic growth source: World Bank Report

Sources:

- https://furtherafrica.com/

- Unesco

- https://www.afdb.org/

- https://africa.com/

- https://furtherafrica.com/

- http://venturesafrica.com

- https://www.greatbusinessschools.org/africa/

- https://www.afdb.org/en/documents/african-economic-outlook-2020

- https://iclg.com/alb/special-report/ivory-coast

Carrie Morris

Author

Warren Dahl

Editor-in-Chief