Because a masters degree isn’t always necessary to work as an accountant, many professionals start their career without it, only to wonder later “should I get my Masters in Accounting?” For those who want to advance in the finance or accounting fields, the answer to the question is a resounding yes.

A bachelor’s degree can often help someone find a good job, but an accounting career really requires a master’s degree. This is especially true for those who want to advance, stand out in a crowd, and find a higher level of success in their chosen career.

Anyone who wants to make the transition from accountant to a Certified Public Accountant should consider achieving their master’s a necessity. CPA requirements vary by state, but the rigorous testing involved doesn’t change. The CPA testing requirements are high, and only those with a master’s level of accounting knowledge should attempt it.

What Should I Know About a Masters in Accounting Degree?

With a Masters in Accounting, someone can easily position themselves as an expert in the field and work towards becoming an incredibly important asset to any business, as every business across the planet needs an accountant with a high level of knowledge.

Accountant or Certified Public Accountant

“Should I get my Masters in Accounting?” A good way of looking at this is by understanding what separates the average accountant from a CPA. The terms aren’t interchangeable, and neither are the job requirements, expectations, or salaries. All CPAs are accountants, but not all accountants are CPAs.

At a basic level, the job duties between the two can start similarly. An accountant deals with financial records and needs a financial education to facilitate accounting work as well as some experience to apply accounting skills to whichever industry or vertical the person chooses to work in.

By contrast, the CPA carries certification and state licensing. The CPA must go through testing to gain that license. Once licensed, the CPA can work in more industries or verticals at a higher capacity. A CPA can achieve higher positions in both the public and private sectors.

Businesses tend to give more responsibility to CPAs and take them on as financial advisors. Where an accountant will typically only ever crunch numbers and create reports, a CPA can help shape financial decisions and policies.

In almost all cases, the best avenue towards becoming a CPA is by way of first earning a Masters in Accounting. These are the challenges and benefits of Masters in Accounting degrees for those who want to pursue a more robust accounting career.

Other benefits of Masters in Accounting come from the other opportunities the degree can open for applicants. CPA testing and licensing isn’t the only path to take, although it’s one of the most popular. Depending on the track a student takes and that student’s goals, they can also pursue other licensing avenues such as the CISA, CFA, CIA, CMA, CPP, and others.

How Do I Choose the Best School or Program? What Should I Know About Accreditation?

Accreditation for accounting programs and schools works like accreditation for any other institute of higher learning. When looking for the best schools and programs, it’s important to pay close attention to the accreditation status of the program.

That status will tell an applicant a lot about the program which can help narrow down the choices. This is an incredibly important consideration, especially when looking for a master’s program. Many accrediting bodies only grant accreditation status to programs of a certain level.

For example, one group may give accreditation to undergraduate programs but not to postgraduate ones. Having a little understanding of what to look for when it comes to accreditation for accounting programs can help.

To start, applicants should check to see if the school they’re considering has proper regional accreditation. Regional accreditation means that one of the seven accrediting agencies that form the Council of Regional Accrediting Commissions has evaluated the school and made sure it’s up to educational standards in every way.

These regional bodies have the backing of the US government and grant the most known and accepted form of accreditation for academic institutions. Nevertheless, regional accreditation typically applies to a school as a whole, rather than its individual programs.

Regional accreditation will ensure an applicant is looking at a school of good quality, but they must dig deeper to find if the accreditation for accounting programs is also of the highest quality. To do so, the applicant must also look for specialized accreditation statuses for Masters in Accounting programs.

For accounting programs, there are three main accrediting agencies:

- AACSB — The Association for Advancing Collegiate Schools of Business

- ACBSP — The Association of Collegiate Business Schools and Programs

- IACBE — The International Assembly for Collegiate Business Education

These groups contain key players, educators, policymakers, important people and groups that shape the world of accountancy. A master’s program with an accredited status from one or more of these groups will prepare a student for moving forward in their careers.

Each of these groups places value on slightly different things, but that isn’t a cause for concern. For example, one group may look for programs that deal more with hands-on training for specific roles while another will prefer programs that give a more academic look at finances to prepare students for different types of roles.

In all cases, students will gain the education they need, but an applicant can always investigate each group to see if their core values match the type of educational experience the applicant desires.

Understand that the importance of accreditation exists across the board. Even if the applicant is specifically looking for online programs, they should look for an accredited online Masters in Accounting programs. These accredited online Masters in accounting programs will have to meet the same standards as programs hosted at physical institutions.

What Are the Different Types of Accounting Master’s Degrees?

A Masters in Accounting degree isn’t just one thing as it can lead to a host of specializations. Sometimes, an applicant may find masters programs that list this degree type under a slightly different. Also, some other master degrees can stand in as an accounting degree to an extent. Some examples include:

- Master of Accountancy

- Masters in Accounting

- Master of Business Administration in Accounting

- Master of Professional Accountancy

- Master of Professional Accounting

- MBA in Accounting

- Masters of Science in Professional Accountancy

- Master of Business in Accounting

When looking for the top MS in Accounting programs, applicants should pay attention to the degree types offered and the curriculum. A slightly different name to the degree can mean a specialization or niche. If the applicant knows exactly what they’re looking for from their masters degree, they wouldn’t want to end up in a program aimed at something completely different.

In most cases, the specialization will have more to do with the electives an applicant chooses rather than the overall program. The top MS in Accounting programs may offer multiple master degree paths. Many program lists will show a Master of Accounting ranking, which can make some people want to choose whichever programs sit at the top of the list.

A Master of Accounting ranking list is only a start. As previously stated, applicants will want programs that align with their goals and have the right accreditation status. No two programs are the same even if they both offer an excellent education. The cheap Masters in Accounting programs can offer just as much value as an expensive program if it meets the criteria that make a program good.

This all applies to online options as well. Online masters programs are sometimes even superior to their offline counterparts. Many well-known institutions offer online masters programs, so it’s not always just a matter of looking at strictly online opportunities. If an applicant comes across a great Masters in Accounting program from a prestigious university, but want an online program, they should check to see if that university offers one.

Pricing for online programs can vary just as much as they do for offline institutions. The cheapest online master’s degree in accounting isn’t necessarily the worst one. People assume the cheapest online Masters in Accounting programs may lack something important, but that’s not always the case.

If the program has a good reputation and accreditation from one of the major accrediting groups, then that program is likely worth considering. The accounting industry and employers don’t care if someone has the cheapest online Masters in Accounting degree, they only care that it came from an accredited program.

So, applicants can feel free to seek Masters in Accounting online cheap, because that degree can still help them move forward in their careers. When looking for a Masters in Accounting online cheap, look for quality.

What Are Some Benefits to an Online Accounting Master’s Degree?

With so much said about an online Master of Accountancy, it’s important to look at why someone should consider an MS in Accounting online as a first choice. An online Master of Accountancy comes with benefits that a student can’t find in a more traditional setting.

Some MS in Accounting online programs come from brick and mortar institutions, so students can often still take advantage of the perks that come from collegiate associations. For example, students can still network, access help from professors when they need it, go to the campus to use certain facilities if they live close by, and many other things.

Students can also receive access to the institution’s online assets which can help a great deal with studying, learning, and finding opportunities as far as internships or professional associations.

As with most master’s degrees, the person pursuing one likely already has a job and adult responsibilities that take up a lot of their time. An online Master of Accountancy can help make pursuing their degree more manageable.

An online Master of Accounting program can allow for a lot of flexibility to accommodate the responsibilities that come with adult life. Students don’t need to commute and can often pursue their online Master’s in Accounting at their own pace. This is an important consideration because some people may want to go all-in with an accelerated Master of Accounting online program while some others may want to pursue their MS in accounting online at a slower pace.

Online MAcc programs or online Master of Accounting courses can require a lot of commitment, but that commitment doesn’t have to look like an all or nothing effort. The ability to find an online Master of Accountancy programs that allow for flexible scheduling can make all the difference between someone achieving their degree and someone passing it by.

An online Master’s in Accounting degree is designed for active professionals. Online MAcc programs offer just as much by way of specialization and electives. A Master of Accounting online still holds just as much weight as a degree from an equally accredited offline program.

Knowing these things should help applicants choose online programs with confidence. If an applicant comes across an online program that costs less than an offline one, allows for more flexibility, and still has the right reputation and accreditation, the applicant shouldn’t hesitate to choose that program.

Does a Master’s in Accounting Require Certifications or Licenses? What About CPAs?

Many people want their Masters in Accounting degree specifically to ready themselves for certification and licensing towards becoming a CPA or other titled accounting professional. State licensing as a CPA doesn’t always require a master’s degree, but the master’s degree gives someone the best possible chance of completing the sometimes-rigorous testing and requirements necessary for licensing.

Another degree type can help someone meet requirements for certain accounting-related licenses or certifications. For example, when it comes to MS Accounting vs MBA, there’s a huge difference. However, an MBA with an accounting focus can prepare someone to go for their CMA license. Also, the MS Accounting vs MBA can come up as an important choice for some as they both have similar prerequisites.

For the question of “what degree do I need to become a CPA,” or for those wondering about the major difference between Masters of Accounting or CPA, there are numerous considerations. Do you need a masters to be a CPA? No. The CPA test is available to people with a bachelors degree but with several caveats. Applicants will have to fulfill the requirements necessary to take and pass the CPA exam.

Applicants must fulfill the requirements to obtain licensing from their state, and those requirements can vary a great deal between states. This means applicants will have to do some research to figure out their specific needs when it comes to figuring out what they will need.

A Master’s in Accounting helps to satisfy most if not all the requirements someone may need. For example, some states may want a graduate degree but also many course hours beyond that degree to satisfy licensure requirements. The master’s degree can help fill in those hours.

With all that said, the Master’s in Accounting or CPA question can also veer towards just obtaining a master’s degree alone. A master’s degree of any type opens a lot of doors for applicants. Someone who obtains their master’s degree in accounting will likely have a better chance of moving forward in their careers or obtaining opportunities that were unavailable with just a graduate degree.

Nevertheless, for applicants who specifically want to work in accounting then the Master’s in Accounting or CPA question tilts more towards obtaining their CPA. So, the question of CPA or Masters in Accounting matters a great deal, but either way, an applicant will find themselves with more opportunities and higher salary potential.

What Are Some Careers in Accounting with a Master’s Degree?

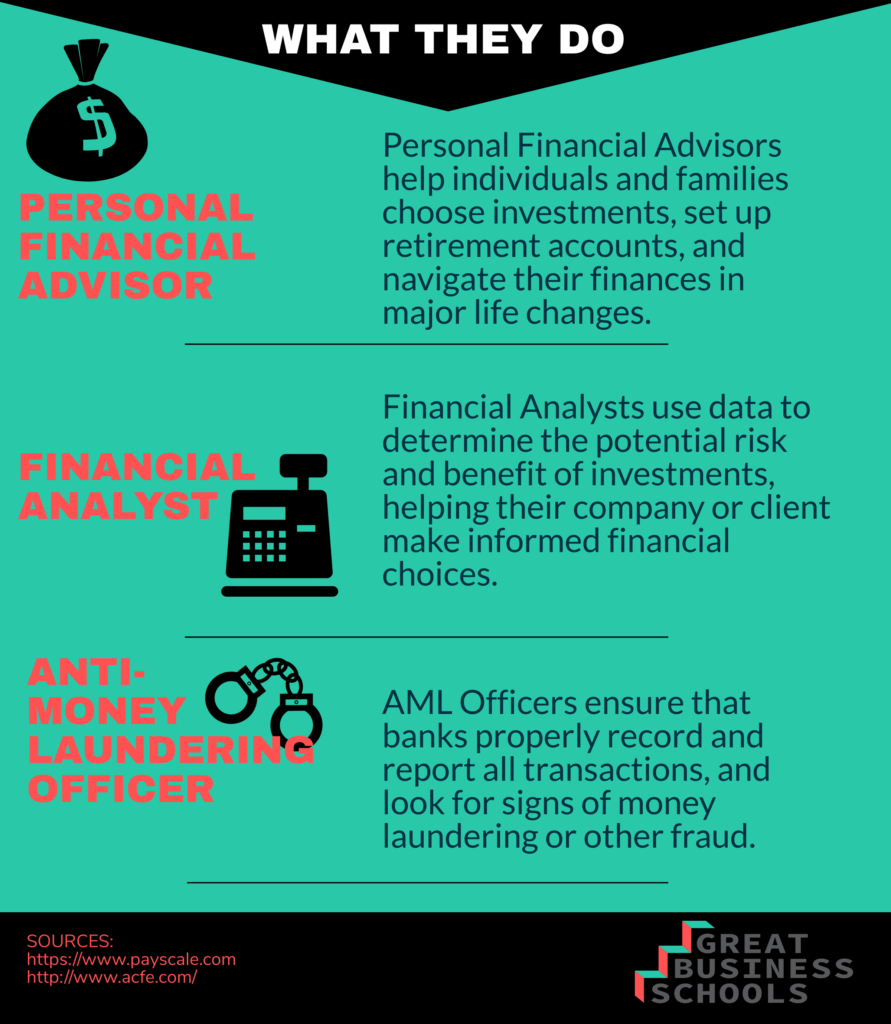

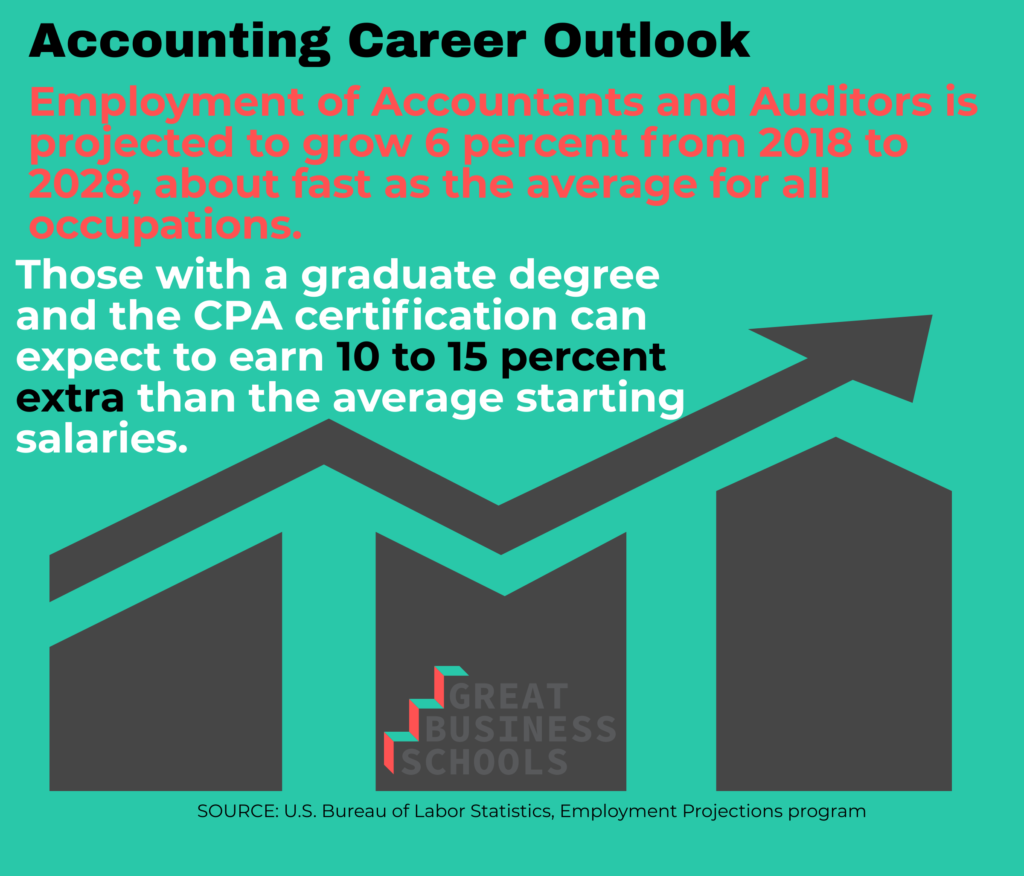

Jobs for Master’s in Accounting graduates are plentiful and even on the rise. The need for professional accounting will always exist, but the need for professional accounting advice, direction, and expertise is where applicants will find the best careers and salary opportunities.

Master’s in Accounting jobs don’t just exist in the world of accounting. The master’s degree itself and knowledge of finance means someone can find work in numerous fields and sectors. Of course, obtaining a CPA or other professional, regulated license can serve someone far better, but Master of Accounting jobs with just the degree itself exist everywhere.

Masters of Accounting jobs and careers can include:

- Accounting Manager

- Chief executive officer

- Auditor

- Financial Accountant

- Chief accounting officer

- Budget Analyst

- Government accountant

- Tax accountant

- Certified Internal Auditor

- Forensic accountant

- Cost accountant

- Treasury analyst

- Chief operating officer

This is nowhere near an exhaustive list. Master of Accounting jobs exist in every niche, field, and anywhere there’s a business. When looking for Masters in Accounting jobs, applicants will also find that having the masters degree also makes them eligible for a plethora of other work opportunities.

What is the Typical Master’s in Accounting Salary?

Master’s in Accounting salary will vary based on factors such as location, industry, specializations, and who is doing the hiring. Applicants should also note that a Master’s in Accounting salary isn’t the same as a CPA salary. In fact, the two things can compliment each other.

For example, the average salary for CPA with master’s degree is typically higher than for someone with a CPA but no masters degree. Having the designation of CPA adds value to a master’s degree worth. This also applies to other licensed designations, not just CPA.

PayScale lists Masters in Accounting salary at $70k on average. PayScale also lists CPA average salary as $65.4k. In both cases, the salary can rise greatly depending on job title, location, and company hiring. This means CPA and Masters in Accounting salary can differ from each other, yet both together can greatly strengthen salary potential beyond what each of them offers individually.

This shows that Masters in Accounting salary, in general, is worth pursuing on its own despite a CPA or other specialization to boost it further. The very same site shows the Master of Science in Accounting salary at $69k, which means the degree type can play a small role as well. However, a Master of Science in accounting salary will also fluctuate greatly based on the same criteria. This can become confusing for someone who wonders how much does a CPA make with a master’s degree. The answer is always more than a CPA would make without a master’s degree.

How much does a CPA make with a master’s degree is also a question that comes up when people want to compare other types of masters degrees as well. For example, what’s the CPA vs MBA salary difference or the MBA vs MAcc starting salary differences. In most cases, MBA salary starts lower than either a CPA or MAcc salary.

Business administration vs accounting salary follows the same pattern. The MS Accounting salary has more of a narrow focus which means it can have a higher demand than a more general business degree. So, whether it’s a Masters in Accounting salary or a Master of Science in Accounting salary, odds are an applicant will find themselves off to a good start.

What Are Some Professional Organizations for Accountants and CPAs?

Numerous professional organizations for accountants and CPAs exist. Even if someone hasn’t achieved their master’s degree or licensing yet, they should already have membership in one or more professional associations. The benefits that come from these groups are too many to count, and every professional should join one as soon as possible.

Professional organizations for accountants exist at local, state, national, and international levels. In some places, it’s almost impossible to even find opportunities if the applicant isn’t part of a local or state organization.

Applicants can also look for professional organizations that serve their niche or industry as well. Consider that accounting plays a major role in business, which means applicants can also join business associations, of which there are hundreds.

However, some accounting-specific professional organizations include:

- American Institute of Certified Public Accountants (AICPA)

- National Association of Certified Public Bookkeepers (NACPB)

- American Accounting Association (AAA)

- American Association of Finance & Accounting (AAFA)

- Institute of Management Accountants (IMA)

There are many, many more organizations besides these. A good place to start is with local organizations. Applicants should check close to home to see what kind of benefits they can find from local organizations even as they look into the larger ones.

These professional groups and organizations offer job opportunities, continuing education services, seminars, exclusive web resources, cutting edge information, and maybe most importantly, networking opportunities. The networking alone is typically worth it to join an association. At every level, these groups can consist of people who create opportunities for advancement within the accounting field.

Carrie Morris

Author

Warren Dahl

Editor-in-Chief