If you have been interested in gathering information about actuarial science to make a career choice, begin by asking these questions –

- What is an Actuarial Scientist?

- An actuarial scientist is a recognized mathematical professional who has the skills to demonstrate and manage uncertainty and financial risk.

- What does an actuarial scientist do?

- An actuarial scientist is an important part of the age of Big Data and now plays an integral role in the areas of business, commerce, government, stocks, and insurance, to name a few industries.

- What is actuarial science about?

- Actuarial science is the science/art of arithmetically and scientifically assessing the risk present in a situation – be it a business investment, an insurance investment, or a stock/bond investment.

- Is actuarial science a good major for a mathematics-oriented student?

What is Actuarial Science About?

While the mathematics and accounting fields are quite lucrative and rewarding professions, it is the actuarial profession that takes the field of accounting to the next level – a career that uses technology, math, statistics, and business principles to make better decisions based on tremendous amounts of data.

What does an Actuarial Scientist do?

Actuaries utilized several inter-related disciplines in their actuarial modeling. These disciplines include–

- Probability Theory.

- Mathematics.

- Finance.

- Economics.

- Statistics.

- Computer Science.

It is noted that the processes and information about actuarial science have been changed dramatically since the 1980s – due to the incredible evolution of the fast-speed computer mainframe.

Choosing a College for Actuarial Science

If you have shown an interest in the field of actuary science, it is a sure bet you have begun to consider which of the best actuarial science schools or top actuarial science colleges may offer an accredited, proven program that meets your education and career objectives.

As you begin your search for the best actuarial schools nearby or investigate some of the top actuarial science programs offered online, it is important to recognize that there are many different types of undergraduate degrees that help prepare students to reach for careers as a professional actuary.

Your research regarding the available top actuary colleges should focus on math degree programs that offer some of the best actuarial science undergraduate programs with program emphases in related math sciences. Also, consider the following when deciding which of the top actuarial science schools would best meet your career and education goals –

- Confirm the top undergraduate actuarial science programs prepare students for the actuarial exams you intend to pursue.

- Determine if these top actuarial colleges you have an interest in provide internship opportunities for students interested in becoming an actuary.

- Learn if the best actuarial science schools and top colleges for actuarial science have been recognized as a CAE – a Center of Actuarial Excellence, as determined by the Society of Actuaries (SOA).

As you continue to investigate and discover which of the top schools for actuarial science meets your needs best, pay attention to the coursework required by each of these top actuarial science colleges, as each program differs significantly.

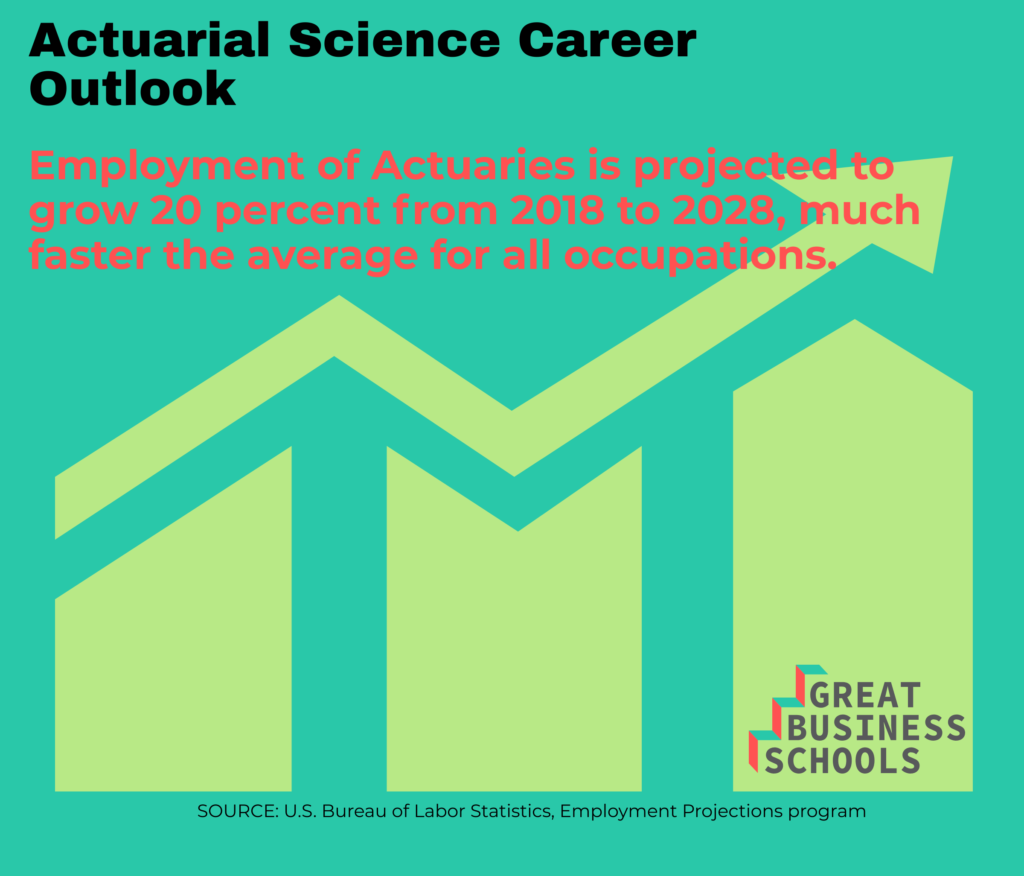

The job outlook for actuaries, according to the Bureau of Labor Statistics (BLS), is quite promising as the federal government statisticians anticipate the actuary job market to grow at a 20% pace through the year 2028 – which is much faster than the nation’s average growth prediction of 8%.

These encouraging economic and job predictions are great news for those students looking to attend one of the best actuarial schools in the country. Be vigilant in your search for the top undergraduate actuarial science programs and top actuary colleges because each program (or school, for that matter) is NEVER created equal.

What is an Actuarial Science Degree?

Business professionals who hold a bachelors degree in actuarial science are risk/math experts who specialize in assessing, identifying, and managing risk from financial perspectives. Graduates who have earned a degree in actuarial science online grow professionally to hold positions of great responsibility with companies in the fields of business, finance, consulting, investment banking, insurance, government, and retirement planning, to name a few.

Graduates who hold online actuarial science degrees complete coursework in the actuary foundational skills and theories of –

- Finance.

- Statistics.

- Math Modeling.

- Economic Theory.

- Interest Theory, among other topics.

Actuarial Science online degrees are a great option for those students who have time constraints and life commitments that make attending an on-campus bachelors degree in actuarial science program. However, it is critical to note that when selecting from some of the best actuarial science degrees online, it is vital to confirm that the coursework offered by a specific degree in actuarial science online prepares degree candidates to sit for the actuarial exams that are sponsored by the SOA – the Society of Actuaries.

Additionally, online actuarial science degrees should be willing to provide any credits received for Corporate Finance & Applied Statistical Methods from VEE – the Validation by Educational Experience of the SOA.

Actuaries who hold actuarial science online degrees are risk specialists. They employ advanced statistical and calculus tools to determine the likelihood of numerous risk factors. Actuaries are taught that risk comes in a variety of forms and that every business/organization faces some sort of risk.

Those who have earned their actuarial science degrees online have the skills and talent to –

- Facilitate the pricing for auto insurance premiums based on known risk factors of the car, the driver and the location/purpose that the care is housed/driven

- Calculate homeowner insurance premiums, considering the many factors that impact the home’s risk of damage.

- Establish retirement plans for future retirees.

- Manage risk for banks, insurance companies, and government agencies, to name a few.

How to Become an Actuary

How long does it take to become an Actuary?

If you have wondered – How long does it take to become an actuary – it likely you also asked yourself the following questions –

- How do I become an actuary by enrolling in an online program?

- How long does it take to become an actuary if I study part-time?

- How many years does it take to become an actuary if I study full-time online?

- How many years does it take to become an actuary? The answer to this question depends upon the individual’s work experience, time constraints, and career objectives. Most actuaries achieve their professional objectives in 6 to 10 years.

- How to become an actuary in the United States? To become an actuary in the United States (or in Canada), an individual will generally need to pass approximately 7 to 10 actuarial exams.

The reality is that becoming an actuary is actually a combination of earning a relevant degree, work experience, and the number of Actuarial Exams you pass when vying for an actuarial designation. However, most actuaries begin their actuarial careers by taking preliminary actuarial exams.

How do I Become an Actuary – The Preliminary Exams

- The Probability Exam (Exam P-SOA)

- The Financial Mathematics Exam (Exam FM – SOA)

- The Investment & Financial Markets (Exam IFM – SOA)

- The Long-Term Actuarial Mathematics Exam (Exam LTAM – SOA)

- The Modern Actuarial Statistics I Exam (CAS) (Exam MAS-I)

- The Modern Actuarial Statistics II Exam (CAS) (Exam MAS-II)

What is an Actuary & What Do Actuaries Do?

To answer this question, it is helpful to know the definition of actuary. According to the Society of Actuaries, the definition of actuary is as follows –

Actuaries are tasked with the responsibility of calculating and managing risk to mitigate potential financial losses in a variety of businesses. If one were to offer an actuary job description, it would describe in-demand professionals with refined communication abilities and the skills to solve complex financial and math issues.

The definition of actuary or the description of an actuary with a specialty in casualty, as adopted by CAS’ Board of Directors (2010), would read as follows – A skilled professional with the ability manage future financial implications based on contingent events – generally with respect to the insurance industry.

As you consider your potential career as an actuary, remember to find the answers to these questions during your education search –

- What does an actuary do who specializes in Life and Health?

- What is an actuary degree that will help meet your education and career objectives?

- Is actuarial science a good career move for someone with your skills?

- What are some available actuaries careers for actuarial science majors?

- What does an actuary do when working in the investment banking field?

- Are there careers as an actuary that will help you meet your career goals?

- Is an actuary a good career decision for someone with excellent math abilities?

- What an actuary does each day?

- What does an actuary do to save clients money from potential losses?

- Is there a description of an actuary position that would meet your career and financial goals?

To answer the question – What is an actuary? – it is important to understand what an actuary does to manage and reduce the risk for their clients. An actuary job description would include developing and designing plans that include the reading and interpretation of large sets of big data that ultimately influences an organization’s or business’ financial and managerial decisions.

What do Actuaries do?

Actuaries are experts in managing risk.

If you have asked – Is actuarial science a good career and match for your financial and math abilities? – then it is important to understand that actuaries career is primarily focused on measuring a future that is filled with uncertainty and risk. Many professionals with careers as an actuary –

- Develop and implement creative techniques to reduce the probability of non-desirable events.

- Assess the probability of future occurrences using math and science calculations.

- Reduce the influence and impact of risky, undesirable events that do happen.

What does an Actuary do?

Using complex mathematical and economic tools, an actuary job description would also require strong analytical education and background.

What is an Actuary?

An actuary is a professional member of a management team that navigates corporations and organizations through a risk-heavy world.

How many Actuarial Exams are There?

Have you considered just how many actuarial exams are there to be taken during your actuary career?

The Actuarial Standards of Practice (ASOPs) for actuaries located in the United States are set forth by the Actuarial Standards Board (ASB). The Actuarial Standards of Practice are the procedures.

- That must be followed when performing actuarial services.

- That must be disclosed through the communication of the final results.

The ASB is tasked with the responsibility of continuously reviewing the standards based on emerging practices and input from professional actuaries and other interested parties.

What is an Actuary Exam?

The actuarial exams are recognized as closed-book tests. Most actuaries find professional work while planning to take the list of actuarial exams that meet their professional objectives.

Many actuarial students choose to intern (while still studying for their actuarial degree) in both the casualty /property facet and the life/health facet of the actuarial field prior to making a decision as to which of the many tests you will take that comprises a list of actuarial exams that are available in the marketplace.

What are the Actuarial Exams? – The Casualty Actuarial Society (CAS) Exam Track

This type of actuarial career deals mostly with the insurance and re-insurance of houses, RV’s, motorcycles, and vehicles.

Those who choose this track earn a Fellow of the Casualty Actuarial Society (FCAS) designation. These professional actuaries must complete this actuarial exam sequence –

- P/1

- FM/2

- IFM/3F

- MAS-I – the average actuarial exams pass rate for the Modern Actuarial Statistics-l for May 2018 of 36%.

- MAS-II — the average actuarial exams pass rate for the Modern Actuarial Statistics-II for October 2018 of 41%.

- Exam 5

- Exam 6

- Exam 7

- Exam 8

- Exam 9

What are the Actuarial Exams? – The Society of Actuaries’ (SOA) Track

The exams for Life and Health Insurance are managed by the SOA – the Society of Actuaries. There are two designations in the Life and Health Insurance path –

- The FSA – the Fellow of the Society of Actuaries is for professionals who have an interest in traditional valuation and pricing working for insurance companies, etc. The CAS publishes the FSA actuarial exam pass rates.

- The Chartered Enterprise Risk Actuary (CERA) is a more generalized designation as it denotes the holder as a professional who can identify and manage risk in a variety of settings, not just insurance The CAS publishes the CERA actuarial exam pass rates.

The FSA – the Fellow of the Society of Actuaries & The Cost of the Actuarial Exams

The FSA designation includes 10 exams. The cost of the actuarial exams includes the fees for the exams for this designation beginning January 2020. These fees do not include the SOA’s study notes.

- P/1 -$250

- FM/2 -$250

- IFM/3F -$350

- SRM – $325

- STAM -$375

- LTAM -$375

- PA – $1,125

- Plus 3 fellowship exams which are contingent upon the specific fellowship path chosen,

It is noted that the SOA offers reduced actuarial exam costs for international candidates.

Certified Enterprise Risk Actuary (CERA) and the Actuarial Exam Costs

What is the actuary exam and/or tests that are required to earn a CERA designation?

This designation provides each actuarial professional with a strong actuarial foundation. There are 7 exams to obtain this designation. For those interested, many obtain a CERA designation as they navigate their way towards an FSA designation.

- P/1

- FM/2

- IFM/3F

- SRM

- STAM

- PA

- ERM Exam (a fellowship level exam)

Note, though; there are additional non-exam requirements that impact an actuary’s career trajectory. These include –

- VEE credits

- A 1-day seminar in professionalism

- Experience

- Online Education modules, to name a few.

Remember that if you are unsure as to which designation would be right for you, you don’t have to make that final decision until you take the fourth actuarial exam.

Careers & Jobs in Actuarial Science

Now that you know what an actuary does professionally, it is important to consider the following actuary science jobs questions next –

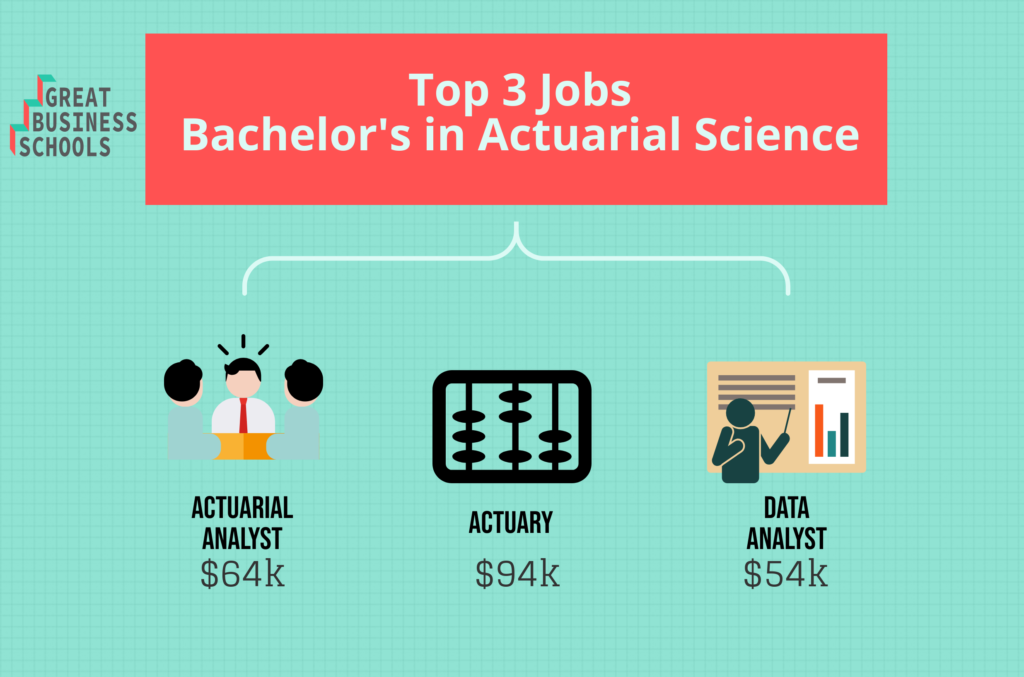

- What jobs can you get with an actuarial science degree?

- What can I do with an actuarial science degree?

- What jobs can I get with an actuarial science degree?

- What can I do with a degree in actuarial science?

- What can you do with an actuarial science degree?

- What are the starting salaries for entry level actuary jobs?

- What is the actuary jobs outlook?

The outlook for actuary science jobs and the future of actuarial science is quite bright. According to the federal government’s Bureau of Labor Statistics (BLS), the job outlook for actuaries is quite promising as these statisticians expect that jobs related to actuarial science to grow at a 20% pace through 2028. This job outlook for actuaries is significantly faster than the country’s average growth prediction of 8%.

This is great news as it offers growthful job opportunities in actuarial science for professional actuaries.

There are many actuarial science degree jobs and jobs for actuarial science graduates that are available across many industries. These jobs for actuaries are available in the following fields –

- Actuarial degree jobs in banking and investment strategies.

- Jobs for actuaries in shipping and/or plane travel.

- Actuarial science jobs in the field of energy.

- Jobs for actuaries in the many different facets of the insurance industry

- Actuary science jobs in environmental issues related to climate change, among other issues.

Additionally, many jobs in actuarial science, which includes entry level actuary jobs and career opportunities in civil service working for the government as follows –

- Actuarial science degree jobs related to Medicare or Social Security.

- Jobs for actuaries related to the Department of Labor.

- Entry level actuary jobs related to pension and retirement planning, to name a few.

Included in the positive actuary jobs outlook are rewarding careers in –

- Jobs in actuarial science working for institutions of higher education.

- Actuarial science jobs related to rating bureaus, labor unions, and accounting firms.

Ultimately, many actuarial science jobs lead to leadership roles in the industry as a Chief Risk Officer.

What is the Salary for an Actuary?

Once you understand the skills and aptitudes required to succeed as a professional actuary, it is likely you have asked yourself the following questions –

- What is the average starting salary for an actuary?

- How quickly would an actuarial science starting salary change during the first five years of experience?

- Do actuary starting salaries improve as one gains experience?

- How does an average salary for an actuary vary by region or area of the country?

- What is the salary of an actuary who has earned several certifications?

- How would an entry level actuary salary differ among industries?

It is important to recognize that an entry level actuary salary will differ (and likely rise significantly) as you gain work experience, additional education, the industry you choose to work in, and professional actuarial certifications.

The average salary for actuaries on a yearly basis is quite impressive, which makes this career choice a smart financial decision. According to the BLS – the Bureau of Labor Statistics, the actuarial science starting salary median statistics are as follows –

- The Median Salary for an Actuary on a yearly basis for 2018 was $102,880.

- The Median Salary for an Actuary on an hourly basis for 2018 was $49.46.

When comparing how the average salary of actuaries fall based upon percentile estimates for May 2018, actuary starting salaries are as follows –

| Salary Percentile | Salary for an Actuary |

| 10% | $ 61,140 |

| 25% | $ 76,720 |

| 50% | $102,880 |

| 75% | $141,760 |

| 90% | $186,110 |

Industries with Highest Average Salary for an Actuary

The average salary for an actuary is highest for actuarial positions located in these states –

| Average Salary of Actuaries | |

| New York | $150,950 |

| Connecticut | $132,910 |

| Washington | $131,330 |

| District of Columbia | $129,540 |

| New Hampshire | $129,110 |

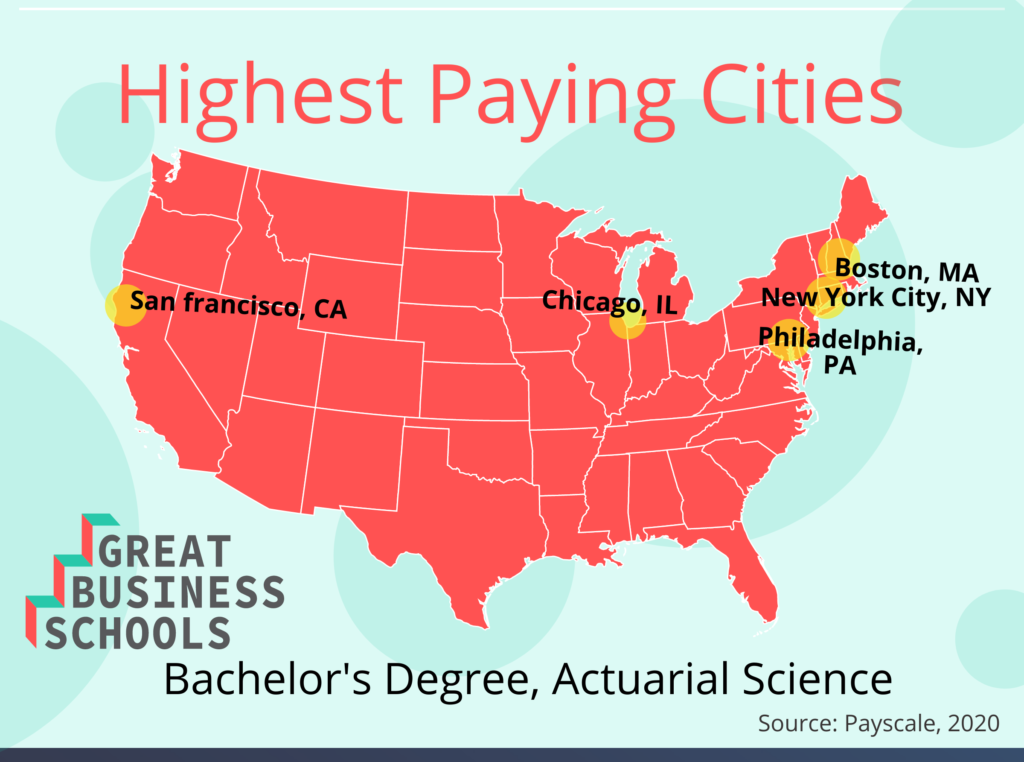

Metropolitan Areas with Highest Average Salary for an Actuary

The average salary of actuaries is highest for actuarial jobs located in these metro areas –

| Average Salary of Actuaries | |

| Bridgeport/Stamford, CT | $151,300 |

| NY-NJ-PA | $149,700 |

| Seattle-Tacoma, WA | $132,450 |

| San Francisco- Oakland, CA | $132,260 |

| Albany-Schenectady, NY | $129,370 |

Professional Organizations

The field of actuarial science, like most established industries, has several reputable professional organizations that advocate for the profession itself and the professionals who maintain the quality and reliability that actuarial science offers the government, businesses, and agencies across the country and the world. Professional organizations offer their members benefits like mentoring, education initiatives, job boards, and certifications, to name just a few.

The Society of Actuaries (SOA)

The Society of Actuaries was established in the 19th century (1889) and holds the distinction of being the oldest global professional network of actuarial professionals. SOA’s membership exceeds 30,000 actuaries. The SOA’s mission to manage and reduce risk through research and the creation of the actuarial leaders of tomorrow. The SOA approves educational opportunities from some of the country’s top actuarial science programs and some of the nation’s top actuarial science schools.

The Casualty Actuarial Society (CAS)

The Casualty Actuarial Society is a recognized leader in the field of education and credentialing worldwide for the field of actuarial science. The CAS celebrated its 100th year anniversary in 2014 and boasts a worldwide membership base of more than 7,500. CAS focused exclusively on property and casualty insurance/risk, finance, and enterprise risk.

The American Academy of Actuaries (AAA)

The American Academy of Actuaries established and identified the ethical and professional standards for actuaries who are members of the academy. The Code of Professional Conduct is available to each member of the AAA.

The American Society of Pension Professionals & Actuaries (ASPPA)

Washington, DC-based The American Society of Pension Professionals & Actuaries operates as a nonprofit organization with a dual mission – to facilitate the education of retirement planning professions and to create a public framework of policies to ensure each American has the opportunity to plan for a comfortable retirement.

Carrie Morris

Author

Warren Dahl

Editor-in-Chief